Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

The Inflation Reduction Act (IRA) is driving rapid growth in the U.S. clean energy equipment manufacturing industry, according to Wood Mackenzie. In ten years, annual U.S. renewable energy generation will triple to 110 gigawatts.

Despite the IRA’s inability to address supply chain and tariff issues, and despite the fact that developers are still waiting for certain provisions of the IRA to be implemented, the benefits of the landmark bill are beginning to be realized, according to the Clean Energy Association. Speaking at the RE+ reference conference in Las Vegas this week, Chris Seiple, vice chairman of the Renewable Energy Group, said: “While we still face challenges, overall, low-cost renewable energy offers a significant opportunity for investment. New annual generation in 10 years’ time is expected to be three times what it is today.”

The IRA, which passed last August, provides for the government to call on nearly $370 billion in funding for investment and production credits for solar, wind, energy storage and key minerals, energy research funding, and manufacturing credits for clean energy technologies such as wind turbines and solar panels. Analysts and industry associations say wind, solar, energy storage, and related manufacturing will boom in the coming years.

Despite the enactment of the IRA in 2022, the amount of new renewable energy installed in the U.S. last year was less than desired. Trade restrictions and supply chain uncertainty have hindered the growth of installed solar capacity, while installed wind capacity has faced challenges such as over-regulation, unstable supply chains, and difficulty of interconnection.

In the first half of this year, the American Council for Clean Energy (ACP) said in a report that the U.S. installed more than 25 gigawatts of wind, solar and storage facilities last year, but total installed clean energy capacity in 2022 experienced its first decline in five years.

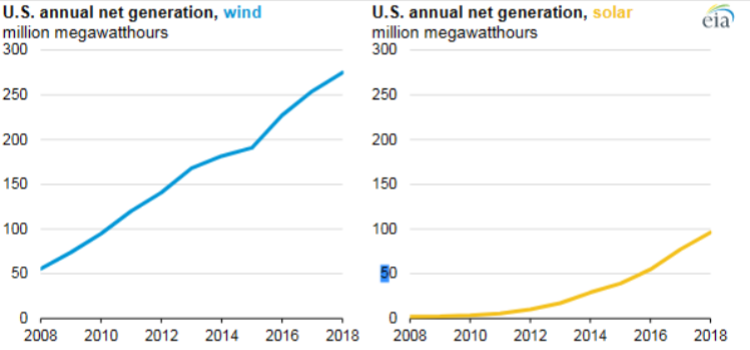

Analysts say the future of the U.S. clean energy market will be free from much of the uncertainty that has characterized it since 2022. The International Energy Agency (IEA) said in its June Renewable Energy Market Update: “The U.S. wind and solar photovoltaic (PV) markets shrank last year due to trade and supply chain constraints, but the annual incremental growth in electricity generation from these two energy sources is set to grow by about 40 percent in 2023, with the solar PV industry set to reach a new record size. The forecast is based on existing tax incentives, and the IRA will go into full effect after 2024, guaranteeing a steady rollout of renewable energy projects through 2032.”

Last week, the Solar Energy Industries Association (SEIA) and Wood Mackenzie projected that the U.S. solar industry will install a record 32 gigawatts of new capacity this year, a 52 percent increase compared to 2022. McKenzie forecasts that total operating solar capacity in the U.S. is expected to increase from the current 153 gigawatts to 375 gigawatts by 2028.

Michelle Davis, head of WoodMac’s global solar division, said, “While the U.S. solar industry doesn’t know how to work with IRAs in the near term, the growth outlook for the industry remains strong.” She pointed out that the IRA will also bring more opportunities for the industry.

In addition to the expansion of installed solar power, solar manufacturing will also flourish. Since the IRA was implemented, more than 50 new solar manufacturing projects have been added in the U.S. Abigail Ross Hopper, president and CEO of SEIA, said at this week’s RE+ conference, “If these facilities are built by 2026, they will produce up to 250 percent of the current U.S. solar demand. 250 percent.SEIA expects the U.S. solar and energy storage industry to increase investment by $565 billion over the next decade and create an additional 500,000 jobs during that time as a result of the IRA.

Between August 2022 and July 2023, the U.S. announced it will invest more than $270 billion in utility-scale clean energy projects and manufacturing facilities, committing more than the last eight years of clean energy investment combined, ACP said in a report last month. Last year alone, the U.S. announced plans for $271 billion in investments and nearly 185 gigawatts of projects, as well as 83 new or expanded utility-scale clean energy manufacturing facilities.

Manufacturing centers in the U.S. are continuing to meet new clean energy needs, with a new wind, solar or storage manufacturing center announced every four days on average,” said ACP CEO Jason Grumet. The only question is whether government policy will allow us to build the clean energy infrastructure in time to capitalize on this opportunity.”